From the Blogs: The future of the euro

09.02.17

A never-ending debate about a currency union that feels like Hotel California.

Ever since the single currency was launched in 1999, there have been commentators warning that it is doomed. They have pointed to the dominance of Germany, to the chronic under-performance of peripheral economies, to huge imbalances between creditors and debtors, and to the rickety political framework that supports it. Yet it has survived crisis after crisis, while its membership has grown even during those crises now to 19 countries. Even so, the debate will not go away.

Last week Ted Malloch, the man likely to become Donald Trump’s ambassador to the European Union, stirred things up by predicting that the euro may collapse in eighteen months, even suggesting that market traders might ‘short it’. This is not fanciful: according to the FT banks are stress-testing a possible break-up because of the popularity of anti-euro parties, with elections imminent in France, the Netherlands and Italy. Now a former IMF chief economist Joseph Stiglitz has weighed in, also warning of a possible collapse in the European currency this year.

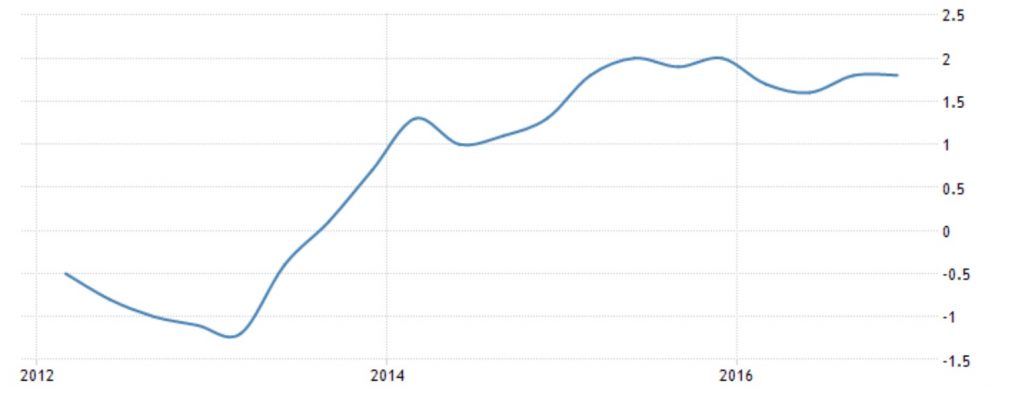

Worries over the euro reached fever-pitch back in 2012 when investors feared Greece, desperate to escape its debt straitjacket, might head for the exit. But after Mario Draghi’s “whatever it takes” speech and the ECB’s subsequent massive injections of liquidity and quantitative easing, sovereign debt yields plummeted and the Eurozone economy recovered slowly but steadily (See Chart). Indeed, the latest signs are that it’s in strengthening health everywhere except for Italy and Portugal, with the Spanish economy growing at 3% and sentiment at a 6 year high. Why the contrast between economic performance and the debate?

Euro area GDP (% change, annual)

SOURCE: Trading Economics.

Stiglitz (a Nobel prize-winning professor at Columbia University), summarising some of the ideas of his recent book, highlights some familiar and long-standing structural problems in the Eurozone – the persistent imbalances between a prosperous North and struggling South, the lack of proper mechanisms for sharing risks, and the (as he sees it) needless and counterproductive insistence on fiscal austerity:

“Thus, the austerity policy—which Germany thought should have brought a quick return to growth—has failed miserably in virtually every country in which it has been tried. The consequences were predictable, and predicted by most serious economists around the world.”

The result, he says is a fractious electorate, now turning their backs on the political elites, in preference for dangerous populist movements. Stiglitz wants to see more risk-sharing inside the eurozone, in particular a common deposit insurance scheme and unemployment safety net to help create greater stability. He warns:

“But the failures of the Eurozone make such reforms increasingly hard. It is at least as likely that the political forces are going in the other direction, and if that is the case, it may be only a matter of time before Europe looks back on the euro as an interesting, well-intentioned experiment that failed—at great cost to the citizens of Europe and their democracies.”

A more cautious assessment is provided by Wolfgang Munchau in the Financial Times, who doesn’t think the euro is about to collapse. He thinks the greatest threats to the EU (and Eurozone) lie in the new realpolitik emerging from Donald Trump’s White House, along with an emboldened Russia and a damaging Brexit deal. However, like Stiglitz he thinks that the Eurozone is an unhappy combination of economic union and national sovereignty:

“…the EU will need to fix the eurozone, and not just to frustrate Prof Malloch’s proposed shorting. This crisis is in its eighth year. The EU needs to stop quarrelling about Greece or fretting about whether the euro can survive the next Italian elections. There are not many options left to fix the eurozone. The history of monetary unions has shown us that it needs to be embedded in a political union to be sustainable.”

That, presumably, means that the eurozone members should accelerate the creation of a federal European state, with nations transferring power to the centre over economic policy. But the prospects for this, given the current mood in Europe, have rarely looked worse.

If one country could bring down the euro, most people think it is Italy. There, a general election later this year or early next could in principle see the Five Star Movement come to power, with its pledge to call a referendum on euro membership. Earlier this month, the head of the IFO Institute, Clemens Fuest, a well-respected German economist, warned that although the eurozone would not break-up in the short-term, Italy might opt to leave if it’s living standards continue to stagnate. And if it did so, then Portugal or Spain might follow suit. The eurozone’s third largest economy, with its huge government debts and wobbly banking sector could then capsize the eurozone ship.

JP Koning, a Canadian economist and blogger, has tried to imagine how Italexit might actually work, by focusing on how the country might reintroduce the lira. The results aren’t pretty. There are huge practical problems with printing enough lira to meet demand and setting an appropriate conversion rate between the euro and lira. In contrast to other situations where a currency is completely replaced by another, the problematic thing about a reversion to the lira is that euros would continue to be legal tender in 18 other countries. Because of that, Italians sensing an impending Italexit would probably hoard euros (knowing they could spend or save them abroad, or convert them later at a favourable rate), precipitating a cash crunch and probable banking collapse.

Koning concludes:

“It is because of these difficulties (and others) that I see euro exit as an incredibly unlikely proposition. The euro isn’t a glove, it’s a Chinese finger trap—once you’ve got it on, it’s almost impossible to get out.”

A sobering conclusion: as in the song Hotel California, you can check out of the euro any time you want, but you can never leave. (Those wanting to better understand how Italy came to join in the first place would do well to read a long and detailed blog by Bill Mitchell, of the University of Newcastle, New South Wales, who argues that the political elites knew all along that the idea was flawed but saw it as the route to economic and political stability.)

The euro, like Britain’s National Health Service, is an institution that has been said to be ‘in crisis’ almost from its inception. But in both cases the crisis isn’t a crisis at all, more a chronic problem that can be managed or alleviated, but not solved. An old joke goes: “Who’d want to live to be 100?” “Answer: someone who is 99.” Something similar could be said of countries, like Italy or Greece, that might seem to have better prospects outside the euro, but will almost certainly choose to stay in. The creation of the euro might not have been the right solution to Europe’s economic problems, but now it exists, there are huge forces that will continue to keep it alive.

Edited by Bill Emmott

- Overall:

- Demography:

- Knowledge:

- Innovation:

- Openness:

- Resilience: